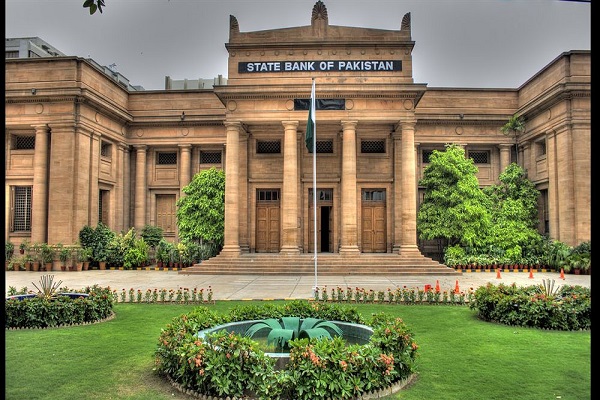

State Bank of Pakistan is Pakistan’s central bank. The bank has offices in fifteen cities of Pakistan, with its head office in Karachi. It has wholly-owned and operating subsidiaries. These include NIBAF (National Institute of Banking & Finance) that serves as the bank’s training arm and gives training to the commercial banks, DPC (Deposit Protection-Corporation).

Recently the bank got ownership of PSPC (Pakistan Security-Printing Corporation). The State Bank of Pakistan holds 3-fully authorized subsidiaries to extend its functions. Dr. Reza Baqir is serving as chairperson of the bank. This article contains all the information about the bank, including the State Bank of Pakistan Introduction.

| Title | Description |

|---|---|

| Details | |

| Type: | Bank |

| Urdu Name: | سٹیٹ بینک پاکستان |

| Industry: | Bank |

| Headquarter: | Karachi, Pakistan |

| Established: | June 1948 |

| Start Working: | 1 July 1948 |

| Principal Officer: | Governor |

| Status: | Central Bank of Pakistan |

| Governer: | Ashraf Mahmood Wathra |

| Chairman: | Governor |

| Currency: | Pakistani rupee |

Table of Contents

State Bank of Pakistan Introduction

The State Bank of Pakistan is established under the 1956 SBP Act that awards its power to perform as Pakistan’s central bank. The act mandates the bank to regulate the country’s credit and monetary system to encourage its growth and development in the national interest or benefit to secure financial stability and complete utilization of Pakistan’s productive resources.

History

During British Raj before independence on 14th Aug 1947, the RBI (Reserve Bank of India) was a reserve bank for Pakistan and India. On 30th Dec 1948, the Commission of British Govt RBI’s reserves between India and Pakistan, i.e., 70% for India and 30% for Pakistan. Muhammad Ali Jinnah, in May 1948, struggled to set up the State Bank of Pakistan immediately. His efforts bore fruit, and on 1st July 1948, the bank started its operations.

Duties of SBP

The bank was assigned the task of regulating Pakistani notes under the bank’s order in 1948 and maintaining the reserves to secure financial stability in-country and operate the credit system and currency of Pakistan to its benefit.

Funding to SBP

Initially, industrial families funded a more significant percentage of this bank. Industrial families on encouragement of Quaid-e-Azam allotted their yearly profit for bank functioning. As Quaid laid the foundation of Pakistan’s 1st textile mill in 1947, the Valika Family having strong terms with Quaid allocated vast shares of their profit to SBP.

During reforms in the country’s financial sector in Feb 1994, the bank was made fully autonomous. On 21st Jan 1997, SBP’s was made more autonomous when Pakistani Govt issued 3-Amendment Ordinances. Those Ordinances included the 1974 Banks Nationalization Act, 1956 SBP Act, and 1962 Banking Companies Ordinance.

Functions of SBP

The bank performs both developmental and traditional functions to accomplish macroeconomic objectives. There are two categories of conventional operations:

- The Primary Functions include supervision & regulation of the financial system, monetary policy, and Pakistani notes.

- Secondary Functions include agency functions such as foreign exchange management, public debt management, etc., along with other functions such as advisor to Govt on matters relating to policy and establishing good ties with Intl financial institutes.

Subsidiaries of State Bank of Pakistan

The State Bank of Pakistan holds 3-fully authorized subsidiaries to extend its functions; these subsidiaries include:

SBP-BSC (Banking Services Corporation)

SBP-BSC was set up under Ordinance 2001 of SBP-BSC and supports the bank in handling currency, credit management, purchase/sale of Government’s savings instruments on behest of National Savings’ Central Directorate, and facilitating system of inter-bank settlement.

It is also assigned to collect the revenue and make payments on the Government’s behalf. It is also responsible for carrying out operational tasks related to public debt management, export refinances, foreign-exchange operations, and finance development.

SBP governor chairs its board of directors and consists of SBP-BSC Managing Director and SBP Central Board’s members. Its head office is located in Karachi.

NIBAF (National Institute of Banking & Finance)

National Institute of Banking & Finance is a bank’s training body and provides training to SBP employees and new inductees. The subsidiary conducts Intl courses on commercial and central banking in association with Federal Govt. Additionally, it is also offering training to SBP-BSC & other financial institutes. The office of NIBAF is in Karachi.

DPC (Deposit Protection Corporation)

It has been set up as an entirely owned SBP subsidiary under the 2016 DPC ACT. This entity would be responsible for protecting deposits of financial institutes working in Pakistan. DPC’s objective is to compensate depositors to the extent of the protected deposits in case of a financial institution’s failure.

DPC would announce protected deposits’ limit and would be announced in time. Following Acts govern functions of SBP:

- Banking Companies Ordinance of 1962

- Foreign-Exchange Regulations Act of 1947

- SBP Act of 1956

- Payment System & Electronic Fund-Transfer 2007 Act

Laws

- State Bank of Pakistan 1956 Act

- SBP Ordinance 2001

- Protection of the Economic-Reforms 1992 Act

- Banking Companies Ordinance of 1962

- The Financial Institutes Ordinance of 2001

- National Accountability-Ordinance of 1999

- Banks Nationalization Act of 1974

- Pakistan Coinage Act of 1906

- Microsoft Institutes Ordinance of 2001

- Payment Systems & Electronic Fund-Transfer Act of 2007

- The Negotiable Instruments Act of 1881

- Pakistan Coinage Act of 2013

- Credit Bureau Act of 2015

- Electronic Transactions-Ordinance 2002

- Credit Bureaus Amendment Act of 2016

- Financial Institutes Act of 2016

- Deposit Protection Corporation-Act of 2016

- Public Finance-Management Act of 2019

- Foreign-Exchange Regulation Act of 1947

Governance

The Board of Directors

A Board of Directors governs the bank that is responsible for the direction of bank affairs and general-superintendent. SBP Governor chairs the board and consists of eight non-executive Directors & Secretary-Finance to Federal Govt. Federal Govt recruits board’s non-executive directors for three-years.

Responsibilities and Functions of the Board of Directors

The Board performs these functions:

- Oversee management of foreign-exchange reserves and approve risk policy and strategic investment

- To determine and define Bank policies regarding implementation of the functions & approve the internal-rules for their execution.

- Reza Baqir-Chairperson

- Naveed Kamran-Finance Division Secretary

- Mohammad Saleem-Board Member

- Ali Jameel-Board Member

- Mehmood Mansoor-Corporate Secretary

- Tariq Hassan-Board Member

Departments

Banking Policy & Regulation Group

- Exchange-Policy Department

- Banking Policy and Regulations Department

Development Finance-Group

- Agricultural Credit and Micro-finance Department

- Islamic-Banking Department

- Infrastructure, Housing, and SME Finance-Department

Banking Supervision-Group

- Banking Inspection Department I and II

- Financial-Stability Department

- Enforcement Department and Off-Site Supervision

- Banking Conduct & Customer-Protection Department

Reserve Management & Financial Market

- Monetary Mgmt. Department and Domestic Market

- Investments Department and Intl Markets

Development Finance-Group

- Agricultural Credit and Micro-Finance Department

- Department of Islamic Banking

Governor Office

- Office of Corporate Secretary

- External-Relations Department

- Internal Audit and Compliance Department

Human Resources

- Human Resource Department

Financial Resource Mgmt

- Risk Mgmt. Department

- Finance Department

State Bank of Pakistan Timings

- Monday to Thursday-09:00 AM-05:30 PM (Lunch Break 01:30 PM-2:30 PM)

- Friday-09:00 AM-5:30 PM

- Saturday and Sunday Closed

Bank Assets and Liabilities

Year Advances Investments Deposits

2002 932,059 559,542 1,466,019

2006 2,189,368 799,285 2,806,645

- Payment Systems

- Library

- Medium & Small Enterprises

- Legal services

- Treasury Operations

- Microfinance

- Corporate & Strategic Planning

- RTGS (Real-Time Gross Settlement) System

- Remittances

- Risk Mgmt. Department

- TDD (Training & Development Department)

- Pakistan Remittance-Initiative

- Information Systems & Technology Department

Social Media Handles

https://twitter.com/StateBank_Pak

https://www.facebook.com/StateBankPakistan/